Beginner

A beginner’s guide to mining Ethereum: Learn how to mine ETH

What is Ethereum mining?

Ethereum mining is the process of using computational power to solve complex mathematical problems in order to validate and verify transactions on the Ethereum network. These problems are designed to be difficult to solve, but easy to verify once a solution has been found. This process is known as proof-of-work (PoW) and it is used to secure the network and prevent double-spending.

Miners are the backbone of the Ethereum network as they provide the computational power needed to solve these problems and validate transactions. In return for their efforts, miners receive rewards in the form of Ether, the native cryptocurrency of the Ethereum network. These rewards are distributed to miners who successfully solve a PoW task, also known as mining a block.

The PoW process relies on the properties of hash functions, which are mathematical algorithms that take an input (or “message”) and return a fixed-size string of characters, called a “hash.” A hash function is a one-way function, meaning that it is easy to compute a hash for any given input, but practically impossible to determine the original input from its hash.

To mine a block, miners must find a specific hash value that meets certain conditions set by the network, known as the “difficulty” level. These conditions are based on the properties of the hash function and are designed to be difficult to solve, but easy to verify. Miners use a combination of parameters, including the previous block’s hash, to generate a new hash that meets the difficulty level.

The process of finding the correct hash is known as “hashing” and it requires significant computational power. The more miners that participate in the network, the harder it becomes to find the correct hash and the more computational power is needed. This is why the difficulty level is adjusted dynamically to maintain a steady rate of block production.

Miners also have a certain “hash rate,” which is a measure of the number of hashes they can perform per second. The more hashing power a miner has, the higher their chances of solving the PoW task and receiving a reward.

This article will guide you on how to mine Ethereum? How Ethereum transactions are mined? How does ethereum mining work?

Why should you mine Ethereum?

There are several reasons why someone may choose to mine Ethereum:

-

Financial gain: The primary motivation for most miners is to make money. By contributing their computational power to the network, miners are able to earn rewards in the form of Ether, the native cryptocurrency of the Ethereum network. As the value of Ether increases, so does the potential reward for miners.

-

Supporting the network: An altruistic community member could decide to mine at a loss just to contribute to securing the network, as every additional hash counts. This is important for maintaining the integrity of the network and ensuring that it remains decentralized.

-

Acquiring Ether: Mining can also be useful to acquire Ether without having to directly invest in the asset. This can be particularly useful for those who are interested in using Ethereum but do not have the financial resources to purchase it outright.

-

Cheaper heating: An unconventional use for home mining is a form of cheaper heating. Mining devices turn electricity into cryptocurrency and heat — even if the cryptocurrency is worth less than the cost of energy, the heat on its own could be useful for people living in colder climates.

-

Experimentation: Some people may choose to mine Ethereum as a way to experiment with the technology and learn more about how it works.

Will the proof-of-stake transition kill Ether mining?

The Ethereum network is planning to transition from a proof-of-work (PoW) consensus mechanism to a proof-of-stake (PoS) mechanism in the future. This transition has raised concerns among miners about the future of mining on the Ethereum network.

Under the PoS mechanism, validators (instead of miners) are chosen to validate transactions and add blocks to the blockchain through the process of staking their own Ether, instead of using computational power. This eliminates the need for miners and their computational power, making mining redundant.

However, the exact timeline for this transition is uncertain. The Ethereum 2.0 Phase 0 launch, expected for 2020, is a separate blockchain that will not impact mining in any way. It’s only with Phase 2 where mining may begin to be deprecated, but there are no concrete plans for that transition as of October 2020.

Phase 2 is expected to come around the end of 2021 or early 2022, but it is worth pointing out that Ethereum has a long history of delays with its roadmap. In 2017–2018, it was widely believed that the transition would be completed by around 2020. So it’s uncertain when exactly the Ethereum 2.0 will be finished, but as of October 2020, most estimates suggest that new miners should have enough time to recoup at least a sizable portion of their investment into hardware.

In conclusion, while the proof-of-stake transition is expected to make mining redundant, miners will still have time to earn a return on their investment. However, it’s important to note that this transition is still ongoing, and the exact timeline is uncertain, so miners should keep an eye on the Ethereum 2.0 roadmap and conduct their own research before investing in mining hardware.

ETH mining profitability: Is mining Ethereum profitable?

Whether any type of mining is profitable depends entirely on the cost of electricity in any given area. As a rule, anything below $0.12 per kilowatt consumed in an hour is likely to be profitable, though prices below $0.06 are recommended to make mining a truly viable economic enterprise.

These figures would disqualify most home mining attempts, especially in developed countries where electricity prices are generally above $0.20. Though it may be possible to turn a profit with such prices, the return on capital could be severely impacted. For example, a miner that costs $3,000 generates $200 per month in revenue and that uses $45 in electricity at $0.05/kWh will take 19 months to repay itself. The same miner used in an area where electricity costs $0.20/KWh will be repaid in 150 months, or over 12 years.

Professional miners can gain an edge by moving their operations into regions with the cheapest electricity or by taking advantage of the generally lower rates reserved for industries. These are some of the primary reasons why mining has turned into a serious and capital-intensive industry.

But mining Ethereum at home is still accessible for most, especially since it can be done with consumer graphics cards made by AMD and Nvidia. For Ethereum miners living in regions with low electricity prices, it can also turn into a strong source of income.

A variety of ETH mining calculators exist that can outline what profits can be expected, for example, Miningbenchmark.net, Whattomine, or CryptoCompare’s calculator. It is also possible to calculate these values independently. The formula used by calculator websites is quite simple:

![]()

This provides an estimate of how much a miner is expected to make in a day. In essence, a miner’s revenue is the total issuance of the network multiplied by their share of the network’s total hash rate. To make a profit, one needs to subtract the cost of the electricity (i.e., the cost of Ethereum mining) used by the miner. For example, a device using 1.5 kWh of electricity at a price of $0.10 will cost $3.6 per day.

The values to plug into the revenue formula can be found online as well. Etherscan will provide an updated estimate of the total hash rate, as well as block times and block reward.

On the Ethereum network, current block times hold at 15 seconds, so there are 5,760 blocks in a day, and the reward is 2 ETH per block as of October 2020. The miner’s hash rate depends entirely on mining hardware, while the network hash rate is the sum total of all miners contributing to the network.

The key to successful mining is maximizing the hash rate while minimizing electricity and hardware costs. Therefore, in addition to location, the choice of mining hardware is crucial for mining.

How Ethereum transactions are mined?

Ether was designed as a coin that could only be mined with consumer graphics processing units, or GPUs. This puts it in contrast with Bitcoin, which can only be mined effectively with specialized devices commonly referred to as application-specific integrated circuit machines, or ASICs. These devices are hardwired to only do one task, which allows them to achieve much higher efficiency than more generic computational hardware.

Making a mining algorithm that is “ASIC-resistant” is theoretically impossible and very hard in practice as well. ASICs designed for Ethereum’s mining algorithm, Ethash, were eventually released in 2018. However, these miners offer a relatively modest improvement over GPUs in terms of hashing efficiency. By contrast, ASICs for Bitcoin are substantially more efficient than GPUs due to the specifics of its mining algorithm.

Another type of specialized device is the FPGA, which stands for field-programmable gate array. These are a middle ground between ASICs and GPUs, allowing some form of configurability while still being more efficient than GPUs at particular types of computations.

It is feasible to mine Ethereum with all of these devices, but not all are practical or sensible. FPGAs, for example, are inferior to GPUs in most circumstances. They are expensive and very complex devices that require advanced technical knowledge to be used effectively. The reward is arguably not worthwhile, as their mining performance remains very close to that of leading GPUs.

Ether ASICs provide a measurable performance boost over graphics cards but carry a host of drawbacks in practical usage. The most important concern is that ASICs can only mine Ethereum and a few other coins based on the same hashing algorithm.

GPUs can mine many other coins and, if push comes to shove, can be resold to gamers or used to build a gaming PC. Additionally, ASICs are harder to source, as few shops sell them, while buying directly from manufacturers may require high order quantities and long waiting times.

So, for the hobbyist home miner, GPUs remain the most sensible choice due to their flexibility and relatively good performance compared to price.

How to find the best mining hardware?

Choosing the right hardware should primarily be dictated by three factors: its maximum possible hash rate, its energy consumption and its purchase price.

The purchase price is sometimes ignored, but it can make or break a mining operation, as hardware does not last forever. Component weardown is a factor, as eventually, all devices will fail. However, this issue is often overblown because GPUs are quite resilient devices, with many reports of them continuing mining for over five years.

The most significant risk affecting miners is hardware becoming obsolete. More advanced GPUs or ASICs can push out existing miners almost completely, especially those with higher electricity costs. Due to this, the “payback period” — how long it takes for the miner to pay itself back — becomes a very important metric for financial analysis in mining.

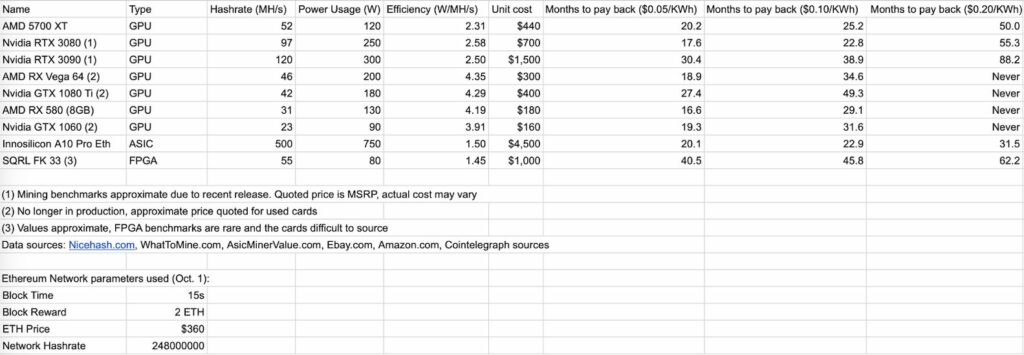

Below is a table listing the financial parameters of leading Ether mining hardware:

You can view and clone the spreadsheet to play around with the values.

The table analyzes the payback period where the lower the value, the better the result. This measure was chosen due to the large differences in hash rate among the devices, which would distort daily profit comparisons.

The calculations completely ignore any fees accrued, which are much more unpredictable than the block reward. Depending on the day, fees contributed 10%–50% of the total daily revenue in the summer of 2020, but historically, they hovered below 10%.

A further caveat is that this table was compiled in an advanced bull market. Some configurations are already failing to make money, and any drop in Ether’s price could exacerbate the situation. Overall, miner revenue fluctuates wildly, and extrapolations of one day’s proceeds into the future can be very unreliable. Miners compete for block rewards with one another, so lowering operating costs below the global average is the key to a resilient business.

Finally, the table ignores the cost of the remaining hardware required to assemble a miner. It is mostly a fixed cost and comparatively cheap, as GPU mining rigs use between six and 14 GPUs. ASICs are largely self-sufficient but, generally, require the purchase of external power supply units.

With those disclaimers in mind, the comparison nonetheless highlights a few differences and drawbacks of various mining hardware options. For example, a three-year old AMD RX 580 is the best value for your money at $0.05 per kWh. But its low energy efficiency makes it a much weaker option than others in the higher electricity cost brackets.

The A10 Pro ASIC is by far the most energy-efficient and attractive option for miners with high electricity costs. Other ASICs were not included due to extreme difficulty in purchasing or a short remaining lifespan. The Nvidia RTX 3080 is also an all-around strong alternative for every category of miners based on preliminary benchmarks.

The SQRL FK 33 is one of the more popular FPGAs, but this model highlights why this type of hardware sees little usage. Despite its high energy efficiency, its unit price still makes it unattractive compared to all the other options. However, it’s worth noting that the sample price figure was derived from the eBay listing of a refurbished second-hand device.

Buying used depreciated GPUs like the AMD RX Vega 64 or the Nvidia GTX 1060 can also be a good cost-saving measure, but buyers may run into a higher risk of device failures.

How does Ethereum mining works: Guidelines and risks

Ethereum mining works by using computational power to solve complex mathematical problems in order to validate and verify transactions on the Ethereum network. Miners use specialized hardware, called ASICs (Application-Specific Integrated Circuits) to perform the complex calculations required for mining. These calculations are designed to be difficult to solve, but easy to verify once a solution has been found. This process is known as proof-of-work (PoW) and it is used to secure the network and prevent double-spending.

The following are some guidelines for mining Ethereum:

-

Research: Before starting to mine Ethereum, it is important to research the process and the equipment needed. This includes understanding the current price of Ethereum, the cost of electricity, and the hash rate of the mining equipment.

-

Hardware: To mine Ethereum, you will need specialized mining hardware, called ASICs. These devices are specifically designed to perform the complex calculations required for mining.

-

Software: Miners also need to run software on their computers to connect to the Ethereum network and perform the mining process. There are several different software options available, such as Geth and Ethminer.

-

Joining a mining pool: Joining a mining pool is an optional but recommended step. A mining pool is a group of miners who combine their computational power to increase their chances of mining a block. When a block is mined, the rewards are split among the members of the pool according to their contribution.

-

Monitoring: It’s important to monitor the mining progress and the profitability of mining. This can be done by keeping track of the current price of Ethereum, the cost of electricity, and the hash rate of the mining equipment.

The following are some risks associated with mining Ethereum:

-

Volatility: The price of Ethereum can be highly volatile, which can greatly impact the profitability of mining.

-

Electricity costs: Electricity costs can be a significant expense for miners, and can greatly impact the profitability of mining.

-

Hardware failure: Mining equipment can fail, which can result in costly repairs or replacements.

-

Difficulty level: The difficulty level of mining Ethereum can change over time, which can impact the profitability of mining.

-

Competition: The number of miners on the network can also change over time, which can impact the profitability of mining. As more miners join the network, the difficulty level increases, making it harder to mine new blocks and reducing the potential reward for miners.

-

Proof-of-stake transition: As mentioned before, the Ethereum network is planning to transition from a proof-of-work (PoW) consensus mechanism to a proof-of-stake (PoS) mechanism in the future. This transition may make mining redundant, which could negatively impact the profitability of mining.

-

Legal risks: Cryptocurrency mining is a relatively new and unregulated industry, which can expose miners to legal risks. Miners should be aware of the laws and regulations in their jurisdiction and ensure that they are compliant.

-

Security risks: Cryptocurrency mining can be a target for cyber attacks, and miners should take necessary security precautions to protect their equipment and the rewards they earn.

In conclusion, mining Ethereum can be a profitable venture, but it also comes with certain risks. Miners should be aware of these risks and take the necessary steps to mitigate them. It’s important to conduct thorough research and be prepared to adapt to the changing market conditions. It’s also important to keep in mind that the profitability of mining can change over time, so miners should continuously monitor the market conditions.