Intermediate

How to calculate Transaction Fees

Transaction fees in the Polkadot blockchain network regulate resource usage by individual users. The fees are calculated from weight, length, and optional tip parameters. The weight fee combines base weight and call weight, while the length fee is based on the transaction size in bytes. A tip can be added by users as an incentive for block authors to prioritize their transaction. The inclusion fee, which is the sum of base fee, length fee, and adjusted weight fee, is deducted from the sender’s account before transaction execution and split between the block author and Treasury. Block producers prioritize transactions based on total fees, with higher fees more likely to be included. The sender of the transaction must cover the fee charged by block producers to cover their expenses. The weight-based fee model in Polkadot, designed by Web3 Foundation Research, aims to efficiently process Relay Chain blocks, limit chain growth, reserve space for important transactions, handle high demand, and provide predictable fee changes for senders.

Fee Calculation

Fees on the Polkadot Relay Chain are calculated based on three parameters:

A Weight fee

Base weight

Call(s) weight

A Length fee

A Tip (optional).

As a permissionless system, the Polkadot network needs to implement a mechanism to measure and to limit the usage in order to establish an economic incentive structure, to prevent the network overload, and to mitigate DoS vulnerabilities. Polkadot enforces a limited time-window for block producers to create a block, including limitations on block size, which can make the selection and execution of certain extrinsics too expensive and decelerate the network. Extrinsics which require too many resources are discarded by the network.

Polkadot defines a specified block ratio ensuring that only a certain portion of the total block size gets used for regular extrinsics. The remaining space is reserved for critical, operational extrinsics required for the functionality by network itself.

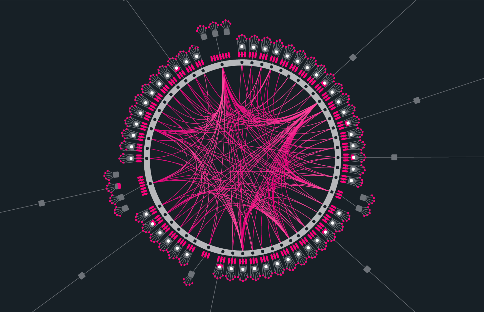

This is handled by a weight system, where the cost of the transactions (referred to as extrinsics are determined before execution. Weights are a fixed set of numbers used in Substrate-based chains to manage the time it takes to validate a block. Each transaction has a base weight that accounts for the overhead of inclusion (e.g. signature verification) and a dispatch weight that accounts for the time to execute the transaction. All weights, even the base weight, are a measure of time to execute on some standard hardware.

The runtime converts weight units to balance units as part of the fee calculation.

The weight fee is the sum of the base weight and the sum of the total weight consumed by call(s).

A TRANSACTION CAN INCLUDE SEVERAL CALLS

For instance, a batch can contain bond and nominate, and the weight would be one base weight and then the sum of the weights for bond and nominate.

To learn more about the motivation of a weight fee, check out this Substrate doc on weights.

The length fee is a per-byte fee multiplier for the size of the transaction in bytes.

There is also a targeted fee adjustment that serves as a multiplier which tunes the final fee based on network congestion. This can constitute an adjusted weight fee calculated as the targeted fee adjustment times the weight fee.

Together, these fees constitute the inclusion fee. The inclusion fee is the base fee plus the length fee plus the adjusted weight fee.

The inclusion fee is deducted from the sender’s account before transaction execution. A portion of the fee will go to the block author, and the remainder will go to the Treasury. This is 20% and 80%, respectively.

Tips are an optional transaction fee that users can add. Tips are not part of the inclusion fee and are an incentive to block authors for prioritizing a transaction, and the entire tip goes directly to the block author.

Final weights are assigned based on the worst case scenario of each runtime function. The runtime has the ability to “refund” the amount of weight which was overestimated once the runtime function is actually executed.

The runtime only returns weights if the difference between the assigned weight and the actual weight calculated during execution is greater than 20%.

Checkout some examples of how various weights are gauged in the Polkadot runtime for several different types of operations:

-

request_judgement – from the identity pallet, allows users to request judgement from a specific registrar

-

payout_stakers – from the staking Pallet, is invoked by a single account in order to payout the reward for all nominators who back a particular validator

-

transfer – from the balances module, is designed to move the specified balance by the sender to the receiver

-

withdraw_unbounded – from the staking module, is designed to move any unlocked funds from the staking management system to be ready for transfer

Block Limits and Transaction Priority

Blocks in Polkadot have both a maximum length (in bytes) and a maximum weight. Block producers will fill blocks with transactions up to these limits. A portion of each block – currently 25% – is reserved for critical transactions that are related to the chain’s operation. Block producers will only fill up to 75% of a block with normal transactions. Some examples of operational transactions:

-

Misbehavior reports

-

Council operations

-

Member operations in an election (e.g. renouncing candidacy)

Block producers prioritize transactions based on each transaction’s total fee. Since a portion of the fee will go to the block producer, producers will include the transactions with the highest fees to maximize their reward.

Fees

Block producers charge a fee in order to be economically sustainable. That fee must always be covered by the sender of the transaction. Polkadot has a flexible mechanism to determine the minimum cost to include transactions in a block.

Transaction volume on blockchains is highly irregular, and therefore transaction fees need a mechanism to adjust. However, users should be able to predict transaction fees.

Polkadot uses a slow-adjusting fee mechanism with tips to balance these two considerations. In addition to block limits, Polkadot also has a block fullness target. Fees increase or decrease for the next block based on the fullness of the current block relative to the target. The per-weight fee can change up to 30% in a 24 hour period. This rate captures long-term trends in demand, but not short-term spikes. To consider short-term spikes, Polkadot uses tips on top of the length and weight fees. Users can optionally add a tip to the fee to give the transaction a higher priority.

Polkadot fees consists of three parts:

Base fee: a fixed fee that is applied to every transaction and set by the runtime.

Length fee: a fee that gets multiplied by the length of the transaction, in bytes.

Weight fee: a fee for each, varying runtime function. Runtime implementers need to implement a conversion mechanism which determines the corresponding currency amount for the calculated weight.

The final fee can be summarized as:

fee = base_fee + length_of_transaction_in_bytes * length_fee + weight_fee

For example, the Polkadot Runtime defines the following values:

Base fee: 100 uDOTs

Length fee: Length fee: 0.1 uDOTs

So, the weight to fee conversion is calculated as follows:

weight_fee = weight * (100 uDots / (10 * 10’000))

A weight of 10’000 (the smallest non-zero weight) is mapped to 1/10 of 100 uDOT. This fee will never exceed the max size of an unsigned 128 bit integer.

Fee Multiplier

Polkadot can add a additional fee to transactions if the network becomes too busy and starts to decelerate the system. This fee can create an incentive to avoid the production of low priority or insignificant transactions. In contrast, those additional fees will decrease if the network calms down and can execute transactions without much difficulties.

This additional fee is known as the Fee Multiplier and its value is defined by the Polkadot runtime. The multiplier works by comparing the saturation of blocks; if the previous block is less saturated than the current block (implying an uptrend), the fee is slightly increased. Similarly, if the previous block is more saturated than the current block (implying a downtrend), the fee is slightly decreased.

The final fee is calculated as:

final_fee = fee * fee_multiplier

The Update Multiplier defines how the multiplier can change. Each runtime has the ability to define this behavior accordingly. For example, the Polkadot runtime internally updates the multiplier after each block according to a custom formula defined here.

Calcuating Fees with Polkadot-JS

One useful utility for estimating transaction fees programmatically is the via the @polkadot/api. Check out the following script that logs some relevant fee information:

// Estimate the fees as RuntimeDispatchInfo using the signer

const info = await api.tx.balances.transfer(recipient, 123).paymentInfo(sender);

// Log relevant info, partialFee is Balance, estimated for current

console.log(`

class=${info.class.toString()},

weight=${info.weight.toString()},

partialFee=${info.partialFee.toHuman()}

`);

For additional information on interacting with the API, checkout Polkadot-JS.

Shard Transactions

The transactions that take place within Polkadot’s shards – parachains and parathreads – do not incur Relay Chain transaction fees. Users of shard applications do not even need to hold DOT tokens, as each shard has its own economic model and may or may not have a token. There are, however, situations where shards themselves make transactions on the Relay Chain.

Parachains have a dedicated slot on the Relay Chain for execution, so their collators do not need to own DOT in order to include blocks. The parachain will make some transactions itself, for example, opening or closing an XCM channel, participating in an auction to renew its slot, or upgrading its runtime. Parachains have their own accounts on the Relay Chain and will need to use those funds to issue transactions on the parachain’s behalf.

Parathreads will also make all the same transactions that a parachain might. In addition, the collators need to participate in an auction every block to progress their chain. The collators will need to have DOT to participate in these auctions.

Other Resource Limitation Strategies

Transaction weight must be computable prior to execution, and therefore can only represent fixed logic. Some transactions warrant limiting resources with other strategies. For example:

-

Bonds: Some transactions, like voting, may require a bond that will be returned or slashed after an on-chain event. In the voting example, returned at the end of the election or slashed if the voter tried anything malicious.

-

Deposits: Some transactions, like setting an identity or claiming an index, use storage space indefinitely. These require a deposit that will be returned if the user decides to free storage (e.g. clear their IDE).

-

Burns: A transaction may burn funds internally based on its logic. For example, a transaction may burn funds from the sender if it creates new storage entries, thus increasing the state size.

-

Limits: Some limits are part of the protocol. For example, nominators can only nominate 16 validators. This limits the complexity of Phragmén.

Advanced

This page only covered transactions that come from normal users. If you look at blocks in a block explorer, though, you may see some “extrinsics” that look different from these transactions. In Polkadot (and any chain built on Substrate), an extrinsic is a piece of information that comes from outside the chain. Extrinsics fall into three categories:

-

Signed transactions

-

Unsigned transactions

-

Inherents

This page only covered signed transactions, which is the way that most users will interact with Polkadot . Signed transactions come from an account that has funds, and therefore Polkadot can charge a transaction fee as a way to prevent spam.

Unsigned transactions are for special cases where a user needs to submit an extrinsic from a key pair that does not control funds. For example, when users claim their DOT tokens after genesis, their DOT address doesn’t have any funds yet, so that uses an unsigned transaction. Validators also submit unsigned transactions in the form of “heartbeat” messages to indicate that they are online. These heartbeats must be signed by one of the validator’s session keys. Session keys never control funds. Unsigned transactions are only used in special cases because, since Polkadot cannot charge a fee for them, each one needs its own, custom validation logic.

Finally, inherents are pieces of information that are not signed or included in the transaction queue. As such, only the block author can add inherents to a block. Inherents are assumed to be “true” simply because a sufficiently large number of validators have agreed on them being reasonable. For example, Polkadot blocks include a timestamp inherent. There is no way to prove that a timestamp is true the way one proves the desire to send funds with a signature. Rather, validators accept or reject the block based on how reasonable they find the timestamp. In Polkadot, it must be within some acceptable range of their own system clocks